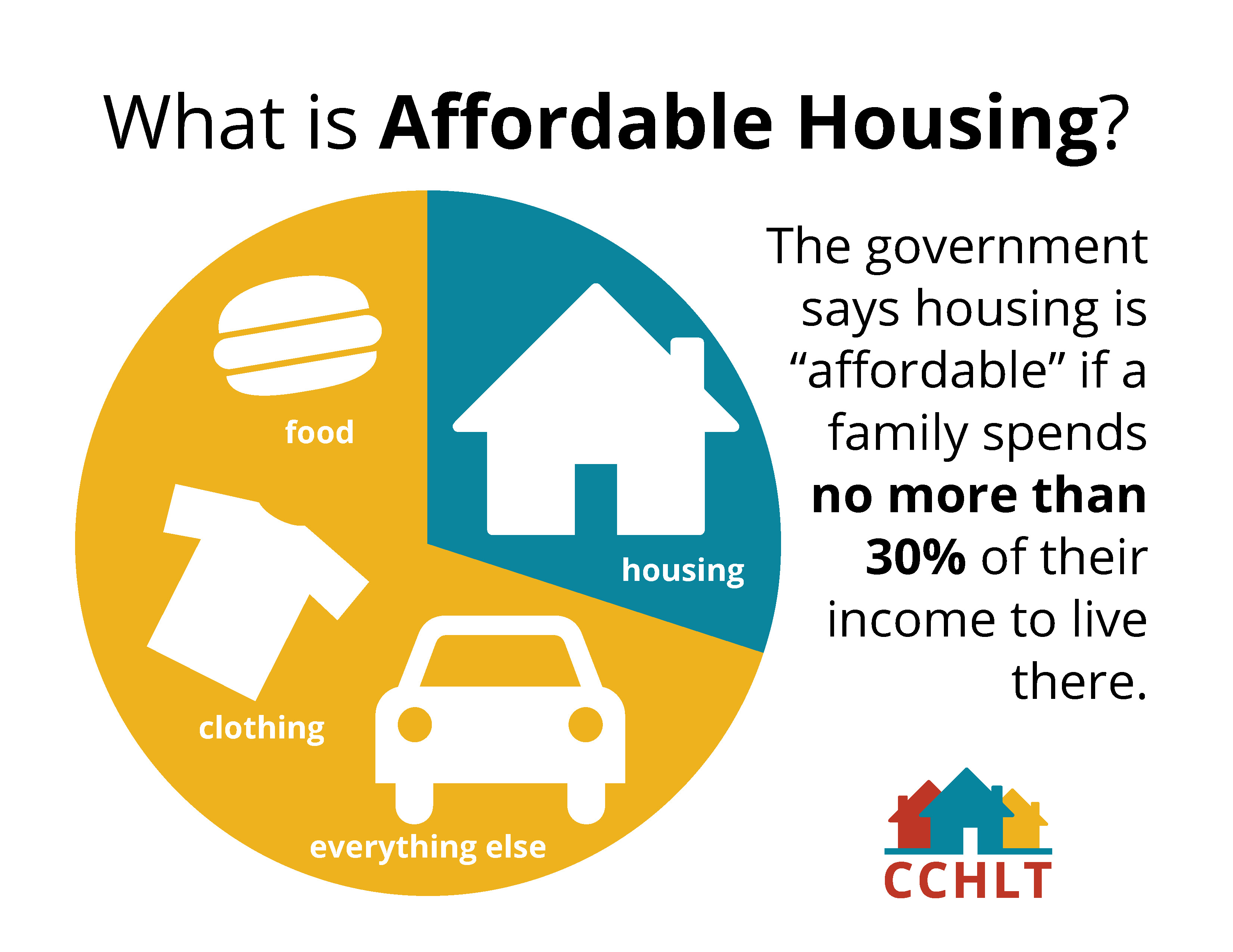

The housing affordability crisis in the United States is a growing crisis that affects millions of Americans. With soaring housing costs and stagnant wages, the dream of homeownership is slipping away from families nationwide. Factors contributing to this crisis include strict real estate regulations and outdated NIMBY land-use policies that hinder development, resulting in significant housing market challenges. Research indicates that such regulations have stifled construction productivity, making it harder for builders to meet the demand for affordable housing. As the situation escalates, understanding the dynamics of housing costs in the USA becomes essential for policymakers and communities alike.

The ongoing struggle for affordable housing in America is often reflected in the increasing costs and limited accessibility to homes. This issue, marked by rising prices and government restrictions, has become a defining characteristic of modern urban environments. Many regions face pressures from local regulations and community opposition to new developments, complicating efforts to alleviate real estate shortages. As economic disparities grow, alternative housing solutions and innovative construction methods are crucial to overcoming these systemic barriers. Hence, addressing the underlying issues centered on housing expenses is vital for creating equitable living conditions for all.

Understanding the Housing Affordability Crisis

The housing affordability crisis in the United States is a pressing issue that affects millions. Rising home prices, which have doubled in real terms since 1960, significantly hinder prospective homeowners. This escalating trend can be attributed to various factors, including labor and material costs, but a critical analysis reveals that local policies, particularly NIMBY (Not In My Backyard) land-use regulations, play a pivotal role. These policies have created barriers to construction, stifling innovation and productivity within the housing sector, which ultimately leads to higher prices for consumers.

Moreover, the situation is exacerbated by the considerable decline in construction productivity since the 1970s. While other industries, like automotive manufacturing, experienced substantial efficiency gains, the housing sector has remained stagnant due to stringent real estate regulations. These barriers prevent builders from utilizing economies of scale, as projects are often smaller and less efficient, which translates into higher housing costs for consumers facing the reality of an increasingly inaccessible market.

The Impact of NIMBY Land-Use Policies on Housing Development

NIMBY land-use policies pose significant challenges to housing development across the United States. The resistance to new construction is deeply rooted in community concerns over density, noise, and environmental impact, leading to regulatory frameworks that limit the scale and speed of new housing projects. Such regulations complicate the planning process, escalating the costs and time required to navigate through zoning restrictions, planning commissions, and public hearings. Consequently, builders are often compelled to create smaller, customized projects that diminish the efficiency and productivity that larger developments could otherwise offer.

This movement away from large-scale housing developments has directly contributed to decreased construction productivity as well. The early and mid-20th century saw a flourishing construction sector, capable of producing thousands of homes quickly and affordably. However, today’s regulatory landscape has resulted in smaller firms focused on low-volume projects, which struggle to innovate and compete effectively. This shift not only impacts builders but also affects the availability of affordable housing options, perpetuating the affordability crisis that many American families are currently facing.

Challenges in the Current Housing Market

The current housing market presents a myriad of challenges for both buyers and builders. As housing costs in the USA continue to soar, the gap between supply and demand widens, making homeownership a distant dream for many. Economic studies suggest that while the national economy has recovered post-recession, the real estate market’s growth remains stagnant, largely due to prohibitive regulations and high construction costs. Buyers, particularly those in the middle-income bracket, are finding it increasingly difficult to enter the market, leading to a backlog of unmet housing needs.

Furthermore, these challenges are compounded by the limited availability of land and zoning laws that favor established neighborhoods over potential developments. Homebuilders are also grappling with rising expenses associated with materials and labor, which are further inflated by the lack of competition in regions where NIMBYism restricts development. This combination of factors not only undermines the housing market but also contributes to burgeoning wealth disparities, as younger generations find themselves excluded from homeownership opportunities that their parents once enjoyed.

The Role of Construction Productivity in Addressing Housing Costs

Construction productivity plays a critical role in determining housing costs and availability. Historical data show that during the post-World War II boom, large developers were able to create affordable housing efficiently due to economies of scale. However, the decline in productivity since the 1970s aligns closely with the rise of restrictive land-use regulations that limit project sizes and complicate approval processes. This shift has forced builders to work less efficiently and innovate less, meaning that new homes are now far more expensive than they ought to be.

Addressing the productivity stagnation in the construction sector is essential for tackling the affordability crisis. One proposed solution is to reassess and revise existing land-use policies to promote larger-scale projects that can harness efficiencies seen in other industries. By increasing construction productivity through regulatory reform, the housing sector can potentially lower costs, making homeownership accessible to a broader segment of the population while revitalizing the economy.

Real Estate Regulations and Their Effects on Housing Affordability

Real estate regulations significantly shape the housing landscape and contribute to the ongoing affordability crisis. These regulations often dictate various aspects of housing development, including zoning laws, minimum lot sizes, and construction standards, which can impose substantial costs on builders. When regulations increase the complexity and expense of building new homes, the resulting higher costs are inevitably passed on to consumers, further exacerbating affordability issues in the housing market.

Additionally, regulations that prioritize the interests of existing homeowners can stifle the development of much-needed new housing. By creating barriers to entry for builders, these rules reduce competition, which can lead to inflated market prices. To combat these effects, many advocate for reforms that would encourage the construction of more affordable housing options, as well as streamline the regulatory process to alleviate some of the pressures facing the industry today. Such changes are vital for ensuring that the housing market can meet the needs of a growing population.

Innovations in Construction: A Path Forward

As the housing affordability crisis deepens, there is an urgent need for innovation within the construction industry. Advances in technology, such as modular and prefabricated building techniques, present new opportunities to enhance productivity and reduce costs significantly. These methods allow for faster construction times and less waste, addressing both the economic pressures on builders and the urgent demand for affordable housing.

Moreover, encouraging the use of new materials and techniques can help attract investment back into the construction sector. Government support for research and development in construction technologies can also be pivotal. By fostering an environment that prioritizes innovation, the industry can break free from the stagnation caused by outdated practices and regulatory hurdles, ultimately paving the way for a more sustainable and affordable housing market.

Intergenerational Wealth Transfer and Housing Ownership

The housing affordability crisis has significant implications for intergenerational wealth transfer as younger generations face barriers to homeownership. Data indicate that median housing wealth for middle-aged Americans has declined sharply, while older generations continue to benefit from rising home equity. This disparity is not only a reflection of the changing dynamics of the housing market but also underscores the broader economic divide emerging in society.

As younger individuals struggle to acquire homes, their ability to build wealth is compromised. The shift towards a rental economy may further entrench these inequities, as renting does not allow for the same wealth accumulation benefits associated with homeownership. Addressing the implications of this trend requires a comprehensive approach to housing policy that not only seeks to ease current market pressures but also provides pathways for future generations to achieve financial stability through home ownership.

Strategies for Mitigating Housing Crisis Challenges

Mitigating the challenges inherent in the housing crisis requires strategic collaboration between policymakers, builders, and community members. Engaging in dialogue with local communities is crucial for understanding their concerns about new housing developments while also addressing the need for increased supply. By fostering partnerships that prioritize transparency and education, communities can be more receptive to new projects that align with their interests.

In addition, introducing incentives for builders to construct affordable housing units can stimulate market activity. Policies that promote mixed-use developments and streamline the permitting process can enhance construction productivity and respond more effectively to community housing needs. By leveraging these strategies, there’s hope for alleviating the pressures of the current housing affordability crisis and creating sustainable solutions for future generations.

The Future of Housing in a Changing Economy

The future of housing in the U.S. hinges on addressing the intricate relationships between economic growth, innovation, and housing affordability. As the economy continues to evolve, there is a growing need to adapt housing policies that allow for flexibility and encourage development. A vision for the future involves not only addressing present-day challenges but also anticipating the demands of an increasing population and changing workforce demographics.

Emphasizing adaptability in housing design and construction methods will be paramount in meeting future needs. By fostering a culture of innovation within the housing sector and promoting regulatory frameworks that enable creativity rather than hinder it, the potential exists for a more equitable and sustainable housing landscape. Ultimately, a commitment to rethinking housing strategies will play a crucial role in shaping a balanced and inclusive economy.

Frequently Asked Questions

What are the main causes of the housing affordability crisis in the USA?

The housing affordability crisis in the USA is primarily driven by rising housing costs, which have more than doubled since 1960. Key factors include increasing labor and material costs, NIMBY land-use policies that limit large-scale construction, and regulations that stifle housing market dynamics, thereby restricting supply and driving prices higher.

How do NIMBY land-use policies contribute to the housing affordability crisis?

NIMBY land-use policies significantly contribute to the housing affordability crisis by imposing strict regulations that restrict the development of larger, more efficient housing projects. This results in smaller construction tasks that fail to leverage economies of scale, reducing construction productivity and increasing housing costs.

In what ways do construction productivity and housing market challenges relate to housing costs in the USA?

Construction productivity has stagnated due to the proliferation of real estate regulations, leading to a decline in the efficiency of housing production. This contributes to housing market challenges, as lower productivity means fewer homes are built, further exacerbating the housing affordability crisis and driving housing costs higher.

What role do real estate regulations play in the increasing housing costs in the USA?

Real estate regulations can create barriers to entry for developers by enforcing extensive approval processes and stringent zoning laws. This heavily regulates the construction sector, leading to fewer large-scale projects, reduced innovation, and ultimately, a significant rise in housing costs, making homeownership less affordable.

How has the size of housing projects changed over the years and its impact on housing affordability?

Over the past few decades, the size of housing projects has declined due to NIMBY land-use policies. With a shift away from large-scale developments, the production of homes per construction worker has fallen, negatively impacting construction productivity and contributing to the escalation of housing costs across the USA.

What is the relationship between housing costs and construction innovation in the context of the housing affordability crisis?

The decline in housing costs is closely tied to construction innovation, which has dropped since the 1970s. This stagnation impacts the housing affordability crisis as fewer innovations mean fewer cost-effective solutions for building homes, ultimately raising housing prices in the market.

How does the housing affordability crisis affect different age groups in the USA?

The housing affordability crisis disproportionately impacts younger age groups, where significant declines in housing wealth have been observed. For instance, median earners aged 35-44 saw their home equity drop drastically from 1983 to 2013, indicating a growing disparity in homeownership opportunities compared to older generations.

What potential solutions exist to combat the housing affordability crisis exacerbated by NIMBYism?

To combat the housing affordability crisis fueled by NIMBYism, potential solutions could include revising land-use regulations to encourage larger development projects, fostering community awareness about the benefits of affordable housing, and implementing policies that streamline the approval processes for new constructions.

| Key Points | Details |

|---|---|

| Housing Affordability Crisis | U.S. housing prices have dramatically increased since 1960, now putting homeownership out of reach for many. |

| Impact of Land-Use Regulations | Tighter land-use controls and NIMBYism limit the scale of homebuilding, leading to higher costs and reduced productivity. |

| Productivity Trends | Construction productivity has declined significantly since 1970, even as the overall economy grew. |

| Large Builders vs. Small Firms | Large construction firms are more productive, but their market share and employment have decreased since the 1970s. |

| Intergenerational Wealth Transfer | Younger generations are accumulating less housing wealth compared to older generations. |

| Historical Perspective | Since the mid-20th century, regulations have hindered large-scale housing projects once popular during the Levittown era. |

| Conclusion on Regulatory Impact | Excessive local regulations and NIMBYism are crucial factors stifling housing growth and fostering the affordability crisis. |

Summary

The housing affordability crisis is a pressing issue in the United States, primarily driven by regulatory constraints and rising costs. Over the years, policies aimed at controlling land use have severely limited the scale of housing developments, stifling competition and innovation within the construction industry. This has resulted in significant increases in home prices, while simultaneously reducing the homeownership prospects for many Americans, particularly younger generations. Addressing these regulatory challenges is crucial to reversing the damaging trends and fostering a more accessible housing market.